RBC Capital Markets, 23 January 2006

Stock Prices – What Happened Last Week?

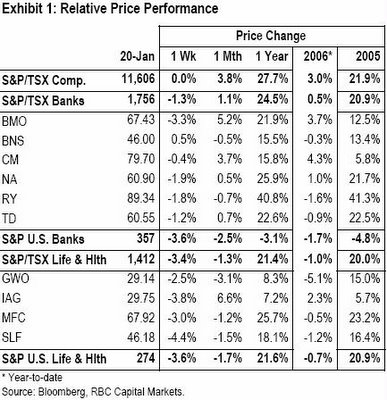

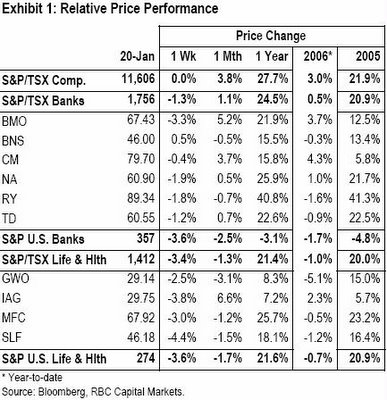

Canadian lifecos were down 3.4% last week amid weakness across North American financials - in the U.S., banks and lifeco’s both dipped 3.6%. Canadian banks fared best, down only 1.3%. BMO pulled back a sharper-than-average 3.3% after a very strong prior week, up 4.7%. BMO and CIBC remain super-sensitive to election news, which appears to be veering to a minority and negative for their merger outlook.

BMO and CIBC are both up ~5% relative to the peers year to-date largely on prospective merger potential driven by the election outlook. With a minority looking most likely, we would look at trades favouring fundamentals at TD and RY again, where wealth management leverage is strongest.

Higher short-term rates have been pushing up Prime and this has been favourable for TD and RY’s lending spreads.

In 2005, the banks were up 20.9%, driven by large increases for Royal Bank (41.3%), TD (22.5%) and NA (21.7%). The banks finished the year just ahead of the lifecos, which were up 20.0%, led by MFC (up 23.2%) and SLF (up 16.4%).

Valuation Update – Lifeco Valuation on the Move

Prefer Lifecos Over Banks in Rising Rates. Canadian lifeco valuations have expanded a full multiple point in the last 3 months, now trading at 13.9x consensus forward earnings - this represents a break-out from the 11-13.5x range since Spring 2002, when Canadian government 10-year bond yields fell below 5%. Despite the strong price performance, lifecos continue to trade at only a 3% premium to the banks (as has been the case through much of the year), and well below the 14% premium since demutualization. We expect lifecos to outperform the banks in a modestly rising interest rate environment.

For banks specifically, there is no longer a cushion between the banks’ consensus forward P/E of 13.5x and our regression forecast of 13.4x at the current yield of 4.01%. However, the banks would lose a P/E multiple for every 50 bps increase in the 10-year Canada yield.

Bank Rank Notes

Ameritrade Reports Q4/05 on Jan 25th. AMTD reports Q4/05 earnings on January 25th, with consensus expectations at US$0.22/share – positive results would be a catalyst for TD, pending 40% owners of this market leader. Schwab (SCHW) reported Q4 results of US$0.14/share last week (in line with the street) on a strong quarter of trading. The TD-AMTD deal is scheduled to close on January 24th, with a special dividend payment of US$6/share the same day to shareholders on record Jan 17th (TD not included).

Federal Election and Bank Mergers. The outcome of today’s Canadian federal elections has implications for merger bank mergers with a minority likely perpetuating the Status Quo ‘limbo’. A surprise majority would probably add upwards of 5% for BMO or CIBC, though we would be very cautious chasing the merger story. In our view, bank mergers would remain a very long-probability – the incentive for a new majority ruling party championing the bank merger is very low, particularly early in their new mandate. We would factor less than 10% probability that mergers happen in the next 12 months. And a minority government, on the other hand, would be even less likely to move ahead on bank merger policy.

;

Stock Prices – What Happened Last Week?

Canadian lifecos were down 3.4% last week amid weakness across North American financials - in the U.S., banks and lifeco’s both dipped 3.6%. Canadian banks fared best, down only 1.3%. BMO pulled back a sharper-than-average 3.3% after a very strong prior week, up 4.7%. BMO and CIBC remain super-sensitive to election news, which appears to be veering to a minority and negative for their merger outlook.

BMO and CIBC are both up ~5% relative to the peers year to-date largely on prospective merger potential driven by the election outlook. With a minority looking most likely, we would look at trades favouring fundamentals at TD and RY again, where wealth management leverage is strongest.

Higher short-term rates have been pushing up Prime and this has been favourable for TD and RY’s lending spreads.

In 2005, the banks were up 20.9%, driven by large increases for Royal Bank (41.3%), TD (22.5%) and NA (21.7%). The banks finished the year just ahead of the lifecos, which were up 20.0%, led by MFC (up 23.2%) and SLF (up 16.4%).

Valuation Update – Lifeco Valuation on the Move

Prefer Lifecos Over Banks in Rising Rates. Canadian lifeco valuations have expanded a full multiple point in the last 3 months, now trading at 13.9x consensus forward earnings - this represents a break-out from the 11-13.5x range since Spring 2002, when Canadian government 10-year bond yields fell below 5%. Despite the strong price performance, lifecos continue to trade at only a 3% premium to the banks (as has been the case through much of the year), and well below the 14% premium since demutualization. We expect lifecos to outperform the banks in a modestly rising interest rate environment.

For banks specifically, there is no longer a cushion between the banks’ consensus forward P/E of 13.5x and our regression forecast of 13.4x at the current yield of 4.01%. However, the banks would lose a P/E multiple for every 50 bps increase in the 10-year Canada yield.

Bank Rank Notes

Ameritrade Reports Q4/05 on Jan 25th. AMTD reports Q4/05 earnings on January 25th, with consensus expectations at US$0.22/share – positive results would be a catalyst for TD, pending 40% owners of this market leader. Schwab (SCHW) reported Q4 results of US$0.14/share last week (in line with the street) on a strong quarter of trading. The TD-AMTD deal is scheduled to close on January 24th, with a special dividend payment of US$6/share the same day to shareholders on record Jan 17th (TD not included).

Federal Election and Bank Mergers. The outcome of today’s Canadian federal elections has implications for merger bank mergers with a minority likely perpetuating the Status Quo ‘limbo’. A surprise majority would probably add upwards of 5% for BMO or CIBC, though we would be very cautious chasing the merger story. In our view, bank mergers would remain a very long-probability – the incentive for a new majority ruling party championing the bank merger is very low, particularly early in their new mandate. We would factor less than 10% probability that mergers happen in the next 12 months. And a minority government, on the other hand, would be even less likely to move ahead on bank merger policy.