BMO Nesbitt Burns Research Report Summary, 16 January 2006

Spreads – Mix and Interest Rates Appear to Have Turned the Corner

In our report, Lower Spreads are Structural (06/27/05) we indicated that we believed that about half of the decline in spreads over the past four years has come from mix, with low absolute levels of interest rates and competitive pressures combining for the remainder.

As we look at each of these variables, there is certainly some cause for optimism not that spreads will return to the levels seen in 2001, but that spreads should be stable or even rise modestly. We will deal with the first two of these factors mix and absolute levels of interest rates below. The third, competitive pressures, is more complex and is dealt with in the following section.

The shift in mix from high-spread, unsecured lending to lower spread, secured lending remains a reality for the future. Banks have generally convinced themselves (as well as their front-line staff and customers) that using secured borrowing capacity is a good idea when compared to unsecured. While this clearly results in lower spreads (often 300 basis points lower), it allows banks to put up less capital and produces structurally lower loan losses. Having said this, we believe that most of the transition is already complete. As we show in Table 3, we believe that the change in 2005 is relatively minor compared to that seen in 2003 and 2004. More stable mix argues for more stable spreads in the coming years.

On the issue of interest rates, the recent increases in administered rates are certainly a positive for Canadian bank core spreads going forward. When the Prime Rate moved below 4% in early 2002 and again in mid-2004, this was clearly a problem. With core margins in the banking system in the 3.50-3.75% range, a Prime Rate of below 4% put pressure on spreads. With very low absolute levels of interest rates during much of 2004 and early 2005, banks were already at zero rates on many deposit products (particularly the 'free' deposits in certain products such as chequing accounts and savings accounts with de minimus rates). As Prime continued to fall, banks were not able to re-price these deposit rates to match the lower yields on loans.

In addition, other deposit balances hit 'psychologically' low levels. GIC rates of less than 100 basis points are often not on the surface sufficiently enticing to encourage consumers to lock in their deposits. Why not just keep the money in a chequing account? The problem here is that banks would need to lock in some funds to ensure that they were not widening their duration gap. In reality, banks generally took the more conservative route and paid a bit more for the term deposits at the expense of spreads.

With the Prime Rate having risen from 3.75% in Q3/05 to 5% currently, one could argue for 8-10 basis points of margin expansion in 2006 when compared to the trough of 2005. Whatever the true number, the reality is that this has gone from a negative to a slight positive.

Competitive Pressures – Some Cause for Optimism Among Bankers

The third factor that has caused spreads to collapse in the Canadian P&C banking system (shown in Chart 1) is competitive pressures. We noted as far back as 2003 in our report, 'Are we Cooking the Golden Goose?' (06/02/03) that competitive pressures on mortgages and deposits were developing. Today, the trend appears to be in the other direction.

A) Signs of Abating Pressure on the Deposit Pricing Front

It is difficult to be definitive on pricing trends in banking. Banks have the ability to source funds in a variety of ways, and can use the proceeds to finance a variety of assets. Furthermore, posted rates are more indicative than they are rigid. Fortunately, there is somewhat more visibility on the deposit side- particularly on high-interest saving accounts. We note that with deposits making up 60% of spread revenues, pricing on this side of the balance sheet is very important to overall spreads.

It is against this backdrop that we closely monitor posted rates on these products, particularly for ING, PC Financial and Manulife, the relatively new entrant ICICI, and the high-interest accounts offered by Scotiabank and Bank of Montreal. As we show in Chart 2, the 75-basis-point increase in Prime since mid-2005 has only produced a 25-40 basis point move in rates on these accounts.

Interestingly, ING no longer appears to be leading the charge for higher deposit pricing as rates rise. Of course, there are other variables- BA rates and other non-administered rates- but this analysis still illustrates that there appears to be some sanity returning to pricing in this segment.

B) ING Bank of Canada – Is the Bloom Coming Off the Tulip?

Note the following comments are on ING Bank- the deposit taking institution, not ING Canada- the property and casualty insurer.

There is no doubt ING Bank of Canada (ING) has been a huge success story over the last seven years. By conducting business mainly over the Internet and telephone, offering very attractive interest rates on deposits and residential mortgage loans with no fees, and advertising aggressively, ING has had a meaningful impact on retail banking practices in Canada. In many ways, the success of ING has been the poster-child for competitive pressure in deposit pricing.

ING now has close to a 3% share of the Canadian retail deposit market. Its success illustrates the power of the Internet and sophistication of the Canadian consumer. Competition is alive and well. Table 4 shows growth rates at ING Bank.

However, recent evidence suggests the bloom may be coming off the ING story and that ING, although still a force in Canada, should not be viewed as a major threat to the Canadian banks' competitive position in retail banking. This evidence includes lower profits and lower growth, and could explain why ING appears to now be somewhat less aggressive. We deal with these two issues below.

As illustrated in Table 5, ING's after-tax earnings are projected to decline 15% in 2005 with a reduction in ROE to 5%. Canada's six largest banks are expected to record an ROE near 17% in fiscal 2005 (inclusive of Enron charges). ING's earnings would have declined even further in 2005 if not for the massive $830 million infusion of new common equity from the Parent over the last two years. In terms of common equity, we believe ING is currently over-capitalized by about $700 million. Removing this cost-free source of funding would reduce estimated net income for 2005 by over $20 million (or 30%), although ROE would increase to 8% from 5%.

The main factor accounting for the erosion in profitability is a falling interest rate spread. As illustrated in Table 5, ING's interest rate spread is expected to decline 15% to 1.58% in 2005.

ING borrows short and lends long and is therefore negatively leveraged to rising interest rates and a flattening yield curve. The yield curve in Canada was abnormally steep in 2004 and has flattened by over 65 basis points (on average) in 2005 (using the spread between the 3-month Treasury Bill rate and the 5-year mortgage rate as a proxy). A further flattening of the yield curve is possible.

In addition, ING's ability to generate investment security gains on its large portfolio of mid-term debt securities is limited in a rising rate environment. Also, the flow of mortgage prepayment fees slows in a rising rate environment.

It should be noted that the erosion of ING's net interest spread in 2005 was moderated by several factors, including the common equity infusion noted previously; asset mix changes as higher yielding loans grew faster than security investments; and less aggressive pricing on the deposit side.

One specific vulnerability of ING is the relative lack of non-interest income. For a typical Canadian bank, non-interest income is 33% of total revenues in the P&C Bank. ING, however, gets over 90% of total revenues from spread revenues and the remainder from non-interest revenues (in the first nine months of 2005, spread revenue was over 97% of total revenues). This means that spread compression is much more painful for ING than for a typical Canadian bank.

In addition to pressure on profitability, it appears as if ING's balance sheet growth, although still impressive, is slowing. We show the growth specifics of ING's balance sheet in Table 6.

On this front, we believe considerations include: 1)ING's higher base: growth from a base of $1.5 billion is obviously easier than from a base of $15 billion; and, 2)more competition. On the deposit side of the balance sheet similarly high deposit rates are offered by Manulife Bank, President's Choice Financial, several credit unions, Bank of Nova Scotia and Bank of Montreal. All large banks are more aggressive in offering better rates and money market alternatives to targeted customers. On the mortgage lending side, most of the large banks are now utilizing the mortgage broker channel while at the same time expanding their own captive sales forces. Discounting from posted mortgage rates by the large banks has increased, again mainly for targeted customers.

We believe that growth in loans and deposits in 2006 for ING will be even below that experienced in 2005. It is also interesting to note that ING has begun to change its formula somewhat. Late in 2005, the bank began offering consumers a 'discount' off their posted rates (i.e., a premium on net new funds received before December 31). We note that the ING consumer proposition so far has been consistent: it offers everyday best value to all. It will be interesting to see whether ING begins to look more like other banks which offer more selective pricing across their product and customer bases.

C) Closing the Loop on P&C Profitability

Spreads do not drive bank share price; it is the impact of spreads on bank earnings that is important. In our report on Retail Banking, 'Canada's Castles Revisited' (10/28/05), we indicated that the outlook for 2006 is good. This is despite the fact that asset growth in 2006 will probably be lower than in 2005. On the other hand, we noted that asset growth of 8-10% in 2005 was mitigated by a reduction in spread of about 15 basis points. In fact, spread revenue only grew by 4%, which is less than nominal GDP.

As we look out to 2006, we believe that asset growth will slow (though there are no signs of this occurring as yet) but that flat to slightly rising spread will allow spread revenue to grow faster in 2006 than in 2005. Taking all this into account, we believe that growth in P&C banking profitability in 2006 will be in the 'low teens.'

Furthermore, with ING profitability well down from the past few years, it appears as if the most potent competitor is less able to create problems in the medium term. P&C earnings (which are the higher multiple parts of the banks) look to be higher and risks appear to be lower.

Not Everything Is Rosy

It is clear that many factors are aligning that point to higher bank earnings in 2006. Having said this, there are a couple headwinds.

First, it is likely that we will see some modest escalation in loan losses after several unusually good years. We are currently expecting loan losses of $2.8 billion in 2006 compared to $1.8 billion in 2005, with an additional $500 million in 2007.

Second, Canadian banks do not generate a large amount of profits from playing the slope of the yield curve, but it is naïve to say that a completely flat curve has no impact on bank earnings. Banks that we believe are most negatively affected by the flat yield curve are BMO, BNS and NA.

Third, the strong Canadian dollar does create some drag on non-Canadian earnings on translation of profits. We believe that a 10% appreciation in the Canadian dollar takes about 2% off bank estimates, with BNS and BMO most impacted. However, we note that Canadian banks are less exposed to moves in currency than are most other sectors of the S&P/TSX.

Valuation Compared to U.S. Peers

The single biggest concern that we have had on Canadian bank stocks is the ongoing widening valuation gap between Canadian bank stocks and those of their U.S. peers. Specifically, we note that after spending most of the past two decades trading at 80% of U.S. bank valuations, Canadian banks have moved to a material premium over the past couple of years (Chart 3).

There are several fundamental factors that suggest that the gap is valid. Canadian banks have established a 'profitability premium,' their balance sheets are stronger and they appear to be building a lower-risk business model.

From our perspective, this is best evidenced in the current environment where the yield curve is flat (or inverted depending on the duration monitored). We are amused by the fact that U.S. banks seem to be taking 'one-time' charges to deal with the fact that they have guessed wrong on the yield curve. U.S. banks typically lend longer than they fund. Canadian banks are highly unlikely to be caught in this manner because of tighter matching, and because they are much more focused on short-term consumer lending than on commercial loans.

We believe the best indication of this is the relative changes in analyst estimates for Canadian and U.S. banks. As we show in Chart 4, Canadian bank earnings estimates have been rising whereas U.S. bank estimates have been falling. This is despite the fact that Canadian banks have had more headwinds from currency than their U.S. peers.

It appears to us that earnings revisions on U.S. banks are likely to continue to be negatively biased whereas the opposite is true in Canada. In the short term, this should continue to support the valuation gap that has opened.

Please Don’t Make Us Talk About Mergers

If there is one statement that indicated the political morass that is bank mergers in Canada, it is the one made by current (as of the time of writing) Prime Minister, Paul Martin. He indicated to Reuters in early January 2006 that, 'I think that the issue is one that's going to have to be resolved, will have to be dealt with.' The lunacy of this statement is that the current government (during which time Mr. Martin has been either Prime Minister or Minister of Finance) has had over seven years to deal with this topic but has come up with numerous deliberate stalling tactics so as not to do so. We list the chronology of these stalling tactics in Appendix 1.

We are not making the case for or against bank mergers' impartial, well-informed individuals could easily come to different conclusions on this topic. Our view is that the biggest problem is the lack of clarity. The Canadian government needs to either allow banks to enter the labourious merger process (by removing artificial hurdles) or declare a moratorium for some period. We believe that either approach would be acceptable; and would be beneficial to the industry. At the very least, banks would be better able to execute on long-term strategy.

A minority government is unlikely to be an environment where bank mergers would be allowed. On the other hand, a Conservative majority government would likely increase the odds of an attempted bank merger. We caution investors of three things: 1)the Conservatives may not win a majority (or even a minority); 2)a political party that held different views when in 'office' than they did when they were in opposition, would not be novel; and 3) the merger review process remains a complex process with many opportunities for politicians to extract concessions (i.e., limits on branch closures, head count reductions, etc.)

Despite all of that, we believe that a prudent portfolio manager would be advised to own one of either BMO or CM to ensure that they are insulated from possible merger speculation. Fortunately, we already recommend CM for fundamental reasons and we believe that this remains appropriate. We have used slightly higher target P/Es than in the past for BMO and CM in setting our target prices.

;

Spreads – Mix and Interest Rates Appear to Have Turned the Corner

In our report, Lower Spreads are Structural (06/27/05) we indicated that we believed that about half of the decline in spreads over the past four years has come from mix, with low absolute levels of interest rates and competitive pressures combining for the remainder.

As we look at each of these variables, there is certainly some cause for optimism not that spreads will return to the levels seen in 2001, but that spreads should be stable or even rise modestly. We will deal with the first two of these factors mix and absolute levels of interest rates below. The third, competitive pressures, is more complex and is dealt with in the following section.

The shift in mix from high-spread, unsecured lending to lower spread, secured lending remains a reality for the future. Banks have generally convinced themselves (as well as their front-line staff and customers) that using secured borrowing capacity is a good idea when compared to unsecured. While this clearly results in lower spreads (often 300 basis points lower), it allows banks to put up less capital and produces structurally lower loan losses. Having said this, we believe that most of the transition is already complete. As we show in Table 3, we believe that the change in 2005 is relatively minor compared to that seen in 2003 and 2004. More stable mix argues for more stable spreads in the coming years.

On the issue of interest rates, the recent increases in administered rates are certainly a positive for Canadian bank core spreads going forward. When the Prime Rate moved below 4% in early 2002 and again in mid-2004, this was clearly a problem. With core margins in the banking system in the 3.50-3.75% range, a Prime Rate of below 4% put pressure on spreads. With very low absolute levels of interest rates during much of 2004 and early 2005, banks were already at zero rates on many deposit products (particularly the 'free' deposits in certain products such as chequing accounts and savings accounts with de minimus rates). As Prime continued to fall, banks were not able to re-price these deposit rates to match the lower yields on loans.

In addition, other deposit balances hit 'psychologically' low levels. GIC rates of less than 100 basis points are often not on the surface sufficiently enticing to encourage consumers to lock in their deposits. Why not just keep the money in a chequing account? The problem here is that banks would need to lock in some funds to ensure that they were not widening their duration gap. In reality, banks generally took the more conservative route and paid a bit more for the term deposits at the expense of spreads.

With the Prime Rate having risen from 3.75% in Q3/05 to 5% currently, one could argue for 8-10 basis points of margin expansion in 2006 when compared to the trough of 2005. Whatever the true number, the reality is that this has gone from a negative to a slight positive.

Competitive Pressures – Some Cause for Optimism Among Bankers

The third factor that has caused spreads to collapse in the Canadian P&C banking system (shown in Chart 1) is competitive pressures. We noted as far back as 2003 in our report, 'Are we Cooking the Golden Goose?' (06/02/03) that competitive pressures on mortgages and deposits were developing. Today, the trend appears to be in the other direction.

A) Signs of Abating Pressure on the Deposit Pricing Front

It is difficult to be definitive on pricing trends in banking. Banks have the ability to source funds in a variety of ways, and can use the proceeds to finance a variety of assets. Furthermore, posted rates are more indicative than they are rigid. Fortunately, there is somewhat more visibility on the deposit side- particularly on high-interest saving accounts. We note that with deposits making up 60% of spread revenues, pricing on this side of the balance sheet is very important to overall spreads.

It is against this backdrop that we closely monitor posted rates on these products, particularly for ING, PC Financial and Manulife, the relatively new entrant ICICI, and the high-interest accounts offered by Scotiabank and Bank of Montreal. As we show in Chart 2, the 75-basis-point increase in Prime since mid-2005 has only produced a 25-40 basis point move in rates on these accounts.

Interestingly, ING no longer appears to be leading the charge for higher deposit pricing as rates rise. Of course, there are other variables- BA rates and other non-administered rates- but this analysis still illustrates that there appears to be some sanity returning to pricing in this segment.

B) ING Bank of Canada – Is the Bloom Coming Off the Tulip?

Note the following comments are on ING Bank- the deposit taking institution, not ING Canada- the property and casualty insurer.

There is no doubt ING Bank of Canada (ING) has been a huge success story over the last seven years. By conducting business mainly over the Internet and telephone, offering very attractive interest rates on deposits and residential mortgage loans with no fees, and advertising aggressively, ING has had a meaningful impact on retail banking practices in Canada. In many ways, the success of ING has been the poster-child for competitive pressure in deposit pricing.

ING now has close to a 3% share of the Canadian retail deposit market. Its success illustrates the power of the Internet and sophistication of the Canadian consumer. Competition is alive and well. Table 4 shows growth rates at ING Bank.

However, recent evidence suggests the bloom may be coming off the ING story and that ING, although still a force in Canada, should not be viewed as a major threat to the Canadian banks' competitive position in retail banking. This evidence includes lower profits and lower growth, and could explain why ING appears to now be somewhat less aggressive. We deal with these two issues below.

As illustrated in Table 5, ING's after-tax earnings are projected to decline 15% in 2005 with a reduction in ROE to 5%. Canada's six largest banks are expected to record an ROE near 17% in fiscal 2005 (inclusive of Enron charges). ING's earnings would have declined even further in 2005 if not for the massive $830 million infusion of new common equity from the Parent over the last two years. In terms of common equity, we believe ING is currently over-capitalized by about $700 million. Removing this cost-free source of funding would reduce estimated net income for 2005 by over $20 million (or 30%), although ROE would increase to 8% from 5%.

The main factor accounting for the erosion in profitability is a falling interest rate spread. As illustrated in Table 5, ING's interest rate spread is expected to decline 15% to 1.58% in 2005.

ING borrows short and lends long and is therefore negatively leveraged to rising interest rates and a flattening yield curve. The yield curve in Canada was abnormally steep in 2004 and has flattened by over 65 basis points (on average) in 2005 (using the spread between the 3-month Treasury Bill rate and the 5-year mortgage rate as a proxy). A further flattening of the yield curve is possible.

In addition, ING's ability to generate investment security gains on its large portfolio of mid-term debt securities is limited in a rising rate environment. Also, the flow of mortgage prepayment fees slows in a rising rate environment.

It should be noted that the erosion of ING's net interest spread in 2005 was moderated by several factors, including the common equity infusion noted previously; asset mix changes as higher yielding loans grew faster than security investments; and less aggressive pricing on the deposit side.

One specific vulnerability of ING is the relative lack of non-interest income. For a typical Canadian bank, non-interest income is 33% of total revenues in the P&C Bank. ING, however, gets over 90% of total revenues from spread revenues and the remainder from non-interest revenues (in the first nine months of 2005, spread revenue was over 97% of total revenues). This means that spread compression is much more painful for ING than for a typical Canadian bank.

In addition to pressure on profitability, it appears as if ING's balance sheet growth, although still impressive, is slowing. We show the growth specifics of ING's balance sheet in Table 6.

On this front, we believe considerations include: 1)ING's higher base: growth from a base of $1.5 billion is obviously easier than from a base of $15 billion; and, 2)more competition. On the deposit side of the balance sheet similarly high deposit rates are offered by Manulife Bank, President's Choice Financial, several credit unions, Bank of Nova Scotia and Bank of Montreal. All large banks are more aggressive in offering better rates and money market alternatives to targeted customers. On the mortgage lending side, most of the large banks are now utilizing the mortgage broker channel while at the same time expanding their own captive sales forces. Discounting from posted mortgage rates by the large banks has increased, again mainly for targeted customers.

We believe that growth in loans and deposits in 2006 for ING will be even below that experienced in 2005. It is also interesting to note that ING has begun to change its formula somewhat. Late in 2005, the bank began offering consumers a 'discount' off their posted rates (i.e., a premium on net new funds received before December 31). We note that the ING consumer proposition so far has been consistent: it offers everyday best value to all. It will be interesting to see whether ING begins to look more like other banks which offer more selective pricing across their product and customer bases.

C) Closing the Loop on P&C Profitability

Spreads do not drive bank share price; it is the impact of spreads on bank earnings that is important. In our report on Retail Banking, 'Canada's Castles Revisited' (10/28/05), we indicated that the outlook for 2006 is good. This is despite the fact that asset growth in 2006 will probably be lower than in 2005. On the other hand, we noted that asset growth of 8-10% in 2005 was mitigated by a reduction in spread of about 15 basis points. In fact, spread revenue only grew by 4%, which is less than nominal GDP.

As we look out to 2006, we believe that asset growth will slow (though there are no signs of this occurring as yet) but that flat to slightly rising spread will allow spread revenue to grow faster in 2006 than in 2005. Taking all this into account, we believe that growth in P&C banking profitability in 2006 will be in the 'low teens.'

Furthermore, with ING profitability well down from the past few years, it appears as if the most potent competitor is less able to create problems in the medium term. P&C earnings (which are the higher multiple parts of the banks) look to be higher and risks appear to be lower.

Not Everything Is Rosy

It is clear that many factors are aligning that point to higher bank earnings in 2006. Having said this, there are a couple headwinds.

First, it is likely that we will see some modest escalation in loan losses after several unusually good years. We are currently expecting loan losses of $2.8 billion in 2006 compared to $1.8 billion in 2005, with an additional $500 million in 2007.

Second, Canadian banks do not generate a large amount of profits from playing the slope of the yield curve, but it is naïve to say that a completely flat curve has no impact on bank earnings. Banks that we believe are most negatively affected by the flat yield curve are BMO, BNS and NA.

Third, the strong Canadian dollar does create some drag on non-Canadian earnings on translation of profits. We believe that a 10% appreciation in the Canadian dollar takes about 2% off bank estimates, with BNS and BMO most impacted. However, we note that Canadian banks are less exposed to moves in currency than are most other sectors of the S&P/TSX.

Valuation Compared to U.S. Peers

The single biggest concern that we have had on Canadian bank stocks is the ongoing widening valuation gap between Canadian bank stocks and those of their U.S. peers. Specifically, we note that after spending most of the past two decades trading at 80% of U.S. bank valuations, Canadian banks have moved to a material premium over the past couple of years (Chart 3).

There are several fundamental factors that suggest that the gap is valid. Canadian banks have established a 'profitability premium,' their balance sheets are stronger and they appear to be building a lower-risk business model.

From our perspective, this is best evidenced in the current environment where the yield curve is flat (or inverted depending on the duration monitored). We are amused by the fact that U.S. banks seem to be taking 'one-time' charges to deal with the fact that they have guessed wrong on the yield curve. U.S. banks typically lend longer than they fund. Canadian banks are highly unlikely to be caught in this manner because of tighter matching, and because they are much more focused on short-term consumer lending than on commercial loans.

We believe the best indication of this is the relative changes in analyst estimates for Canadian and U.S. banks. As we show in Chart 4, Canadian bank earnings estimates have been rising whereas U.S. bank estimates have been falling. This is despite the fact that Canadian banks have had more headwinds from currency than their U.S. peers.

It appears to us that earnings revisions on U.S. banks are likely to continue to be negatively biased whereas the opposite is true in Canada. In the short term, this should continue to support the valuation gap that has opened.

Please Don’t Make Us Talk About Mergers

If there is one statement that indicated the political morass that is bank mergers in Canada, it is the one made by current (as of the time of writing) Prime Minister, Paul Martin. He indicated to Reuters in early January 2006 that, 'I think that the issue is one that's going to have to be resolved, will have to be dealt with.' The lunacy of this statement is that the current government (during which time Mr. Martin has been either Prime Minister or Minister of Finance) has had over seven years to deal with this topic but has come up with numerous deliberate stalling tactics so as not to do so. We list the chronology of these stalling tactics in Appendix 1.

We are not making the case for or against bank mergers' impartial, well-informed individuals could easily come to different conclusions on this topic. Our view is that the biggest problem is the lack of clarity. The Canadian government needs to either allow banks to enter the labourious merger process (by removing artificial hurdles) or declare a moratorium for some period. We believe that either approach would be acceptable; and would be beneficial to the industry. At the very least, banks would be better able to execute on long-term strategy.

A minority government is unlikely to be an environment where bank mergers would be allowed. On the other hand, a Conservative majority government would likely increase the odds of an attempted bank merger. We caution investors of three things: 1)the Conservatives may not win a majority (or even a minority); 2)a political party that held different views when in 'office' than they did when they were in opposition, would not be novel; and 3) the merger review process remains a complex process with many opportunities for politicians to extract concessions (i.e., limits on branch closures, head count reductions, etc.)

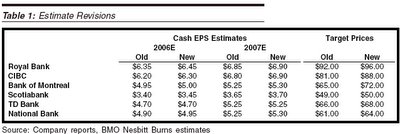

Despite all of that, we believe that a prudent portfolio manager would be advised to own one of either BMO or CM to ensure that they are insulated from possible merger speculation. Fortunately, we already recommend CM for fundamental reasons and we believe that this remains appropriate. We have used slightly higher target P/Es than in the past for BMO and CM in setting our target prices.