The Technical Speculator, Donald W. Dony, 12 June 2006

The early May rally in the TSX Composite now appears likely to be the price top of a bull market that began in October 2002. As the dominant trading pattern of the stock markets, the four year cycle, slowly unfurls towards its anticipated low in October 2006, the trading action of the leading sectors add increasing evidence that the slow decline down for the TSX is already underway.

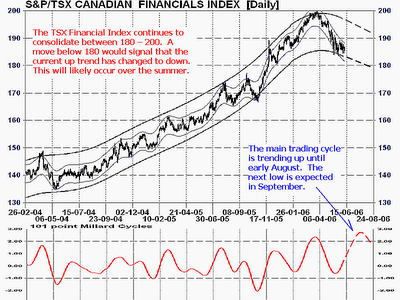

The weighting of the financial sector equals about 1/3rd of the TSX. It is also normally a leading indicator on the composite due to its sensitivity to rising interest rates. As indicated in the lower portion of chart one, the main three month trading cycle for this key sector bottomed in late May and has started to climb towards its anticipated cycle peak in early August; however, this group has only languished in flat trading under the resistance level of 190. With a cycle peak in early August, the clock rapidly ticks-down for this group to display any strength. And without a forceful move from the Financial Index, the possibility of the TSX Composite staging a summer rally to new highs remains very unlikely.

The TSX Composite Index holds a similar trading pattern to its largest component. In the lower portion of chart two, the main trading cycle was also at a low in late May and is now slowly climbing towards an expected cycle peak in early August. The Composite, which should have moved in coordination with its main trading cycle, has yet to commence any signs of a rally. This action strongly indicates growing weakness with Canada’s foremost Index.

Bottom Line: Without strong participation over the next four weeks from the largest sector of the TSX, Canada’s Composite will likely not be able to move to new highs in the coming months which will signal the end of the current bull market.;